Gambling advertising in football has been a controversial issue ever since the first deal was struck. As one of the most watched sports competitions worldwide, the Premier League and its clubs, are seen as ideal partners for gambling companies to get brand exposure. For clubs the financial return is often irresistible, despite the ethical questions these sponsorships raise.

Gambling advertising in football has been a controversial issue ever since the first deal was struck. As one of the most watched sports competitions worldwide, the Premier League and its clubs, are seen as ideal partners for gambling companies to get brand exposure. For clubs the financial return is often irresistible, despite the ethical questions these sponsorships raise.

Now, Premier League clubs have collectively agreed to no longer allow front-of-shirt sponsorship by gambling firms from the 2026/27 season onwards. The first UK sports league to do so.

Although rumours hinted at a ban for a while, it is still a major decision. Especially given the Premier League’s sponsorship market and the role gambling companies play in it. How big of a role do gambling firms have historically within the Premier League? And how will the decision to limit their sponsorship opportunities affect the league’s clubs?

Ban to Reduce Gambling Advertising

The idea behind the ban on front-of-shirt sponsorship by gambling firms is to “reduce gambling advertising”, according to the Premier League. There are concerns about the effects of gambling advertising on the number of people actively involved, with damaging effects, in sports betting.

The idea behind the ban on front-of-shirt sponsorship by gambling firms is to “reduce gambling advertising”, according to the Premier League. There are concerns about the effects of gambling advertising on the number of people actively involved, with damaging effects, in sports betting.

According to the UK Government, problem gambling affects an estimated 300,000 people in the UK. And with a 2021 documentary by Channel 4 revealing that “gambling logos can appear more than 700 times in a single football match,” it is unsurprising that the role of gambling advertising in football (and sports) is reviewed and debated.

Discussions between the league, clubs and the Department for Culture, Media, and Sports has now resulted in a voluntary change. Rather than a government-imposed one, as is the case in several other European countries.

However, the ban only applies to the sponsorship of the front of matchday shirts. This means clubs can still agree partnerships with gambling firms for their sleeves, training wear or in-stadium and digital advertising. In addition, there is a three-season transition period before the limitations come into effect at the end of the 2025/26 season.

Which Gambling Sponsorships can Premier League Clubs Have?

| When | Front matchday shirt | Sleeve matchday shirt | Training wear | In-stadium & other advertising |

|---|---|---|---|---|

| Until 2025/26 | ✅ | ✅ | ✅ | ✅ |

| From 2026/27 | ❌ | ✅ | ✅ | ✅ |

The Rise of Gambling Sponsorships

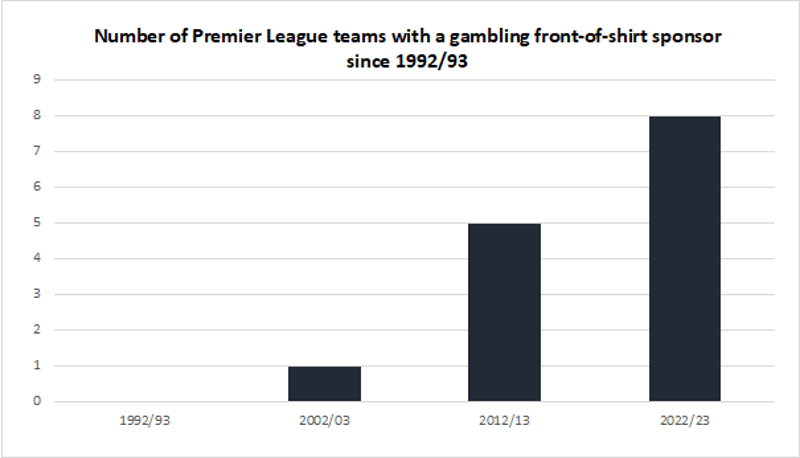

Gambling companies featuring on the front of matchday shirts is a trend of the last two decades. Fulham was the first Premier League side to have a gambling front-of-shirt sponsor when they entered an agreement with betfair.com in 2002. They were the only club with a betting partner featuring on their kits during the 2002/03 season. The telecommunications industry sponsored six teams, the most, that season. While alcoholic brands featured on the shirts of both Leeds United and Liverpool.

A decade earlier, in 1992/93, there were no gambling front-of-shirt sponsors. From the 24 teams playing in the inaugural Premier League season, eight had a partnership with an electronics company.

During the 2012/13 season, 25 percent of the teams (five) had a gambling company featuring on their matchday shirt. Joint-most with companies offering financial services.

Last season, eight teams featured a gambling logo on their shirtfront. Between 2018/19 and 2022/23, there were always eight to 10 gambling companies active as main shirt sponsor in the Premier League.

Introduction of Sleeve Sponsorships

The amount of gambling companies featuring as Premier League shirt sponsor has thus increased over the last three decades. When the league started to allow sleeve sponsorships from the 2017/18 season onwards, the number of clubs featuring a gambling logo on their shirts, front and/or sleeve, became even higher.

The amount of gambling companies featuring as Premier League shirt sponsor has thus increased over the last three decades. When the league started to allow sleeve sponsorships from the 2017/18 season onwards, the number of clubs featuring a gambling logo on their shirts, front and/or sleeve, became even higher.

In 2022/23, there were two gambling sleeve sponsors, bringing the total number of Premier League sides with a gambling logo on their shirts to 10. While there were three gambling sleeve sponsors during the 2019/20 and 2020/21 seasons. Although this included brands who featured as both front-of shirt and sleeve sponsor.

Comparing the front-of-shirt and sleeve sponsors since the introduction of the latter in the Premier League, suggests that gambling companies prefer front-of-shirt sponsorships over sleeve deals. Although front-of-shirt deals are more expensive, they provide higher visibility and gambling companies consider it worth the extra investment.

Other Partnerships with Bookies

Yet, gambling partnerships are not exclusive to shirt and sleeve sponsorships. Before the start of the 2023/24 season (August 2nd, 2023), 13 out of 20 Premier League sides had an affiliation with a betting firm. Seven out of 17 confirmed shirt sponsors were gambling firms, while at least two clubs will feature a gambling logo on their sleeves during the season.

In addition, seven clubs have a general deal with a gambling firm, which often includes pitch-side advertising. This includes three clubs – Aston Villa, Burnley, and Fulham – with two different (shirt and general) gambling related partnerships.

Crystal Palace and West Ham both have a gambling shirt sponsor, but do not list these brands as official partners on their website. Palace’s website, instead, features two partners focused on raising awareness for gambling addiction and responsible gambling.

Gambling Sponsorships in the 2023/24 Premier League (as of August 2nd, 2023)

| What | Number of teams |

|---|---|

| Total | 13 |

| Shirt sponsorships | 7 |

| Sleeve sponsorships | 2 |

| Other sponsorships | 7 |

| More than one deal | 3 |

Big Six vs Non-Big Six

From the traditional Big Six teams, Tottenham Hotspur is the only team to have had a gambling shirt sponsorship since the start of the Premier League in 1992/93. Spurs played with casino company Mansion.com on the front of their matchday shirts between 2006/07 and 2009/10. (Note: apart from Manchester City, who played 27 seasons in the Premier League across three spells, the Big Six teams competed in all 32 Premier League seasons).

From the traditional Big Six teams, Tottenham Hotspur is the only team to have had a gambling shirt sponsorship since the start of the Premier League in 1992/93. Spurs played with casino company Mansion.com on the front of their matchday shirts between 2006/07 and 2009/10. (Note: apart from Manchester City, who played 27 seasons in the Premier League across three spells, the Big Six teams competed in all 32 Premier League seasons).

None of the teams has had a gambling sleeve sponsor since the patches were allowed in 2017/18. Arsenal and United played without a sleeve sponsor in 2017/18, while Tottenham introduced their first sleeve sponsor in 2021/22 with online car retailer Cinch.

Chelsea and Manchester United are the only two teams from the Big Six to list a betting partner on their website (as of August 2nd, 2023).

Gambling Sponsorships of Premier League Big Six

| What | Who |

|---|---|

| Shirt sponsorship since 1992/93 | Tottenham Hotspur: Mansion.com 2006/07 – 2009/10 |

| Sleeve sponsorship since 2017/18 | None |

| Partner (as listed on website) as of August 2nd, 2023 | Chelsea: PariMatch Manchester United: Betfred |

More Middle and Low Table Clubs Have Gambling Partnerships

While the Premier League’s biggest clubs have a limited number of gambling partnerships, middle and low table clubs generally have such deals more frequently.

This despite the traditional Big Six having a high number of marketing partners across many different categories. It seems bigger clubs have an easier time securing sponsorship deals with non-gambling firms that are financially rewarding enough.

While middle and low table teams can secure better financial terms with gambling firms than with non-gambling companies.

Financial Rewards Versus Ethical Concerns

It becomes a trade-off between financial rewards and ethical concerns. Not all clubs are willing to partner with gambling companies though. The voluntary ban also shows that clubs are aware of the negative effects of gambling advertising and thus have ethical worries.

It becomes a trade-off between financial rewards and ethical concerns. Not all clubs are willing to partner with gambling companies though. The voluntary ban also shows that clubs are aware of the negative effects of gambling advertising and thus have ethical worries.

Premier League debutant Luton Town, for example, deliberately foregoes partnerships with gambling companies. In 2018, chief executive Gary Sweet told the BBC, the club did not feel comfortable being sponsored by gambling companies: “We don’t want to promote excessive gambling behaviour through our support base and our players.” Still playing in the League One at the time, the chief executive said the club probably received at least one offer from the gambling industry each season. The decision based on ethical beliefs may have cost the club in “excess of half a million pounds”.

Everton, on the other hand, decided to replace online car retailer Cazoo for gambling company Stake.com in 2022. A deal that would not have happened in “an ideal world” based on past words from chief executive Denise Barrett-Baxendale. Showing that financial rewards do outweigh ethical considerations for some clubs.

Fans’ Ethical Concerns

When Stake.com used Everton’s imagery to promote a free $10 bet for anyone who wagered $5,000 within a week in 2022, fans and campaign groups heavily criticised the Toffee’s involvement. The club told their partner to stop using its imagery in the campaign. A petition signed by nearly 40,000 fans called on the club to end the partnership. However, for now, Stake.com will appear on Everton’s matchday shirts during the 2023/24 season.

When Stake.com used Everton’s imagery to promote a free $10 bet for anyone who wagered $5,000 within a week in 2022, fans and campaign groups heavily criticised the Toffee’s involvement. The club told their partner to stop using its imagery in the campaign. A petition signed by nearly 40,000 fans called on the club to end the partnership. However, for now, Stake.com will appear on Everton’s matchday shirts during the 2023/24 season.

Chelsea did withdraw from a potential deal with Stake.com after fan backlash in the summer of 2023. According to a survey by the Chelsea Supporters’ Trust, 77 percent of fans disagreed with the deal, that had a potential value of £40 million. The London club is still on the look-out for a new partner to replace telecommunications company Three for the 2023/24 season.

Do Fans Favour the Sponsorship Ban?

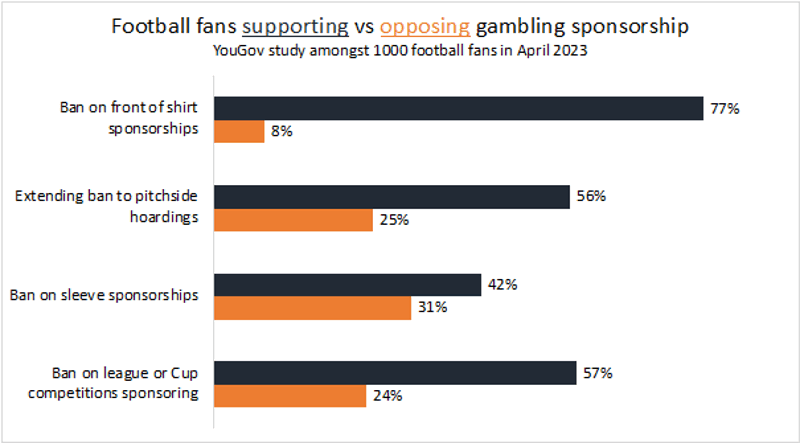

Fans are generally in favour of banning gambling sponsorships. A study by YouGov amongst 1000 UK football fans in April 2023, showed that 77 percent supports the ban. Only eight percent opposes it.

In addition, 56 percent believes it to be a good idea to extend the ban to pitchside hoardings. A smaller percentage, 42 percent, supports a ban on sleeve sponsorships by gambling companies. Which is still more than the 31 percent who oppose such a ban. While 57 percent would approve of gambling companies unable to sponsor leagues or cup competitions.

Public Pressure in Line with Alcohol Sponsorship

Yet, fans believe betting firms to be more inappropriate as marketing partner for teams than alcohol brands. According to YouGov, 77 percent of football fans believe gambling companies are inappropriate marketing partners for teams. While 19 percent believe they are appropriate. For alcohol this is 52 percent versus 39 percent.

Cryptocurrency (60 vs 19 percent) and fast-food (50 vs 40 percent) are also generally considered inappropriate partners, albeit to a lesser extent than gambling companies.

Football Fans Stance on Marketing Partners from Different Industries YouGov Study Amongst 1000 Football Fans in April 2023

| Industry | Inappropriate | Appropriate |

|---|---|---|

| Betting | 77% | 19% |

| Cryptocurrency | 60% | 19% |

| Alcohol | 52% | 39% |

| Fast-food | 50% | 40% |

Varying Financial Rewards

The amounts clubs receive from gambling partners vary based on factors like a club’s size and popularity, the kind of partnership, and whether there is exclusivity.

Although the Big Six does not have a gambling shirt sponsorship, reports suggest Stake.com were willing to pay £40 million to Chelsea to feature on their matchday shirtfronts.

Everton, on the other hand, reportedly receive £10 million from Stake.com for their front-of-shirt sponsorship. Although these are rumoured values, it shows a significant difference between what a Big Six club can obtain from sponsorship and a non-Big Six club.

Value of (Gambling) Shirt Sponsorships Over Time

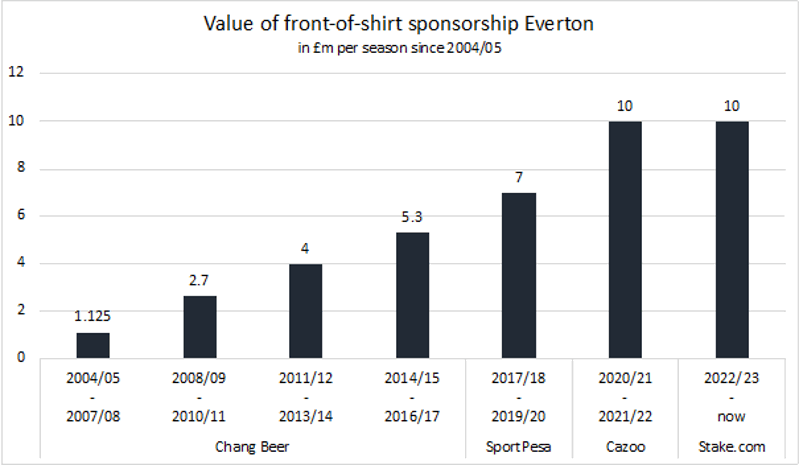

Since 2004, Everton’s income from front-of-shirt sponsorship has steadily increased. A reflection of the Premier League’s growth during that time. The Toffees agreed a four-year £4.5 million deal with Chang Beer in 2004/05. By 2014, the two agreed on a third extension of their partnership. With the three-year deal having a reported value of £16 million.

In 2017, the club closed a five-year deal worth £7 million per season with gambling company SportPesa. The club ended the deal three years into the term for strategic and ethical reasons. For the 2020/21 and 2021/22 seasons, car retail platform Cazoo became the club’s main shirt sponsor for £10 million per year. Better financial terms, despite it being a non-gambling firm. Yet, the deal did not get extended.

The return to a gambling sponsor, Stake.com, suggests the club could not find a non-gambling alternative for a similar financial package. The COVID-19 pandemic and Everton’s decline in performance in recent years could have played a role in this as well.

Gambling vs Non-Gambling Deals for Non-Big Six Teams

Since 2019, West Ham receives £10 million as well from their deal with Betway. In 2015, the gambling company replaced foreign exchange broker Alpari who paid the club around £3 million per season. The Hammers improved on this deal when they received £20 million over a three-and-half year period from Betway.

This season, Aston Villa has switched from Cazoo to gambling brand BK8. The three-year deal is said to be worth significantly more than their previous £6 million per season partnership. While Crystal Palace’s deal with gambling brand W88 in 2021/22 reportedly generated £6.5 million.

Wolves’ deal with payment solutions provider AstroPay, has with £10 million per year the same financial package as Everton and West Ham’s deals with a gambling company.

While Brighton has a long-running all-inclusive partnership with American Express. In 2019, the two extended the deal for a further 12 years with a reported value of over £100 million. A 20-fold increase on the previous deal, in which the shirt sponsorship part of the deal had a value of around £1.5 million.

Difficulty Meeting £6 Million Valuation

Sheffield United’s 2022/23 main shirt sponsor, Randox Health, decided against renegotiating their three-year Championship-deal. Although the club has had multi-million pound offers from gambling companies, they decided against those for ethical reasons.

However, it appears that, for now, no non-gambling company has met the club’s £6 million sponsorship package valuation, as they launched their 2023/24 kits without a front-of-shirt sponsor.

Big Gap with Big Six

The biggest clubs have no such issues and generate far more from front-of-shirt sponsorships. Manchester City is said to receive £45 million per year from their deal with Etihad Airways, while city rivals United earned £64 million per year with their Chevrolet deal.

These clubs get more exposure, not least because of European football, and thus brands are willing to pay more.

Valuation of some Premier League front-of-shirt sponsorship deals

| Club | Value per season | Partner | Season |

|---|---|---|---|

| Manchester United | £64 million | Chevrolet | 2020/21 |

| Manchester City | £45 million | Etihad Airways | 2020/21 |

| Everton | £10 million | Stake.com | 2022/23 |

| West Ham | £10 million | Betway | 2022/23 |

| Wolves | £10 million | AstroPay | 2022/23 |

| Crystal Palace | £6.5 million | W88 | 2021/22 |

| Aston Villa | £6 million | Cazoo | 2022/23 |

Dubious Partnerships

In addition to the ethical concerns surrounding gambling advertising, Premier League clubs have struck deals with dubious gambling brands in recent years. The Athletic investigated several sponsorship deals in 2021, including Chelsea’s deal with gambling firm Leyu Sports. In multiple instances they found the companies and people involved covered in mystery, including fake profile pictures and false information.

Southampton terminated their deal with LD Sports before the 2020/21 season, one year into a three-year contract, because of business concerns. The deal was worth £7.5 million per season, a record for the club. Supposedly a sports content and entertainment platform, it turned out to be a gambling company. And while the marketing focus was always going to be on the Chinese market, the brand was yet to launch in the UK by the time they became Southampton’s partner.

Aston Villa’s new three-year shirt sponsorship deal with BK8 is also surrounded by doubts. Norwich City ended their deal with the firm prematurely in 2021 due to use of sexually provocative marketing content. It has led to major concern and backlash from Villa fans.

There are numerous such sponsorship deals, mostly with gambling companies, but also with cryptocurrency brands, that have come under scrutiny in recent years. Many of the gambling partners have their main (original) market of operation in Asia and have a European gambling license with an office in Malta, Cyprus, or the Isle of Man. However, the precise location, the full business operations and the owners are not always clear. Raising questions whether clubs do their due diligence, or just look at the financial rewards.

What is the Gambling Regulation like in Other European Leagues?

These dubious partners and the debate around gambling advertising is not exclusive to the UK. Many European countries and leagues face pressure to ban or restrict gambling advertising in sports. Some have already implemented such legislation, while other are planning to in the coming years.

These dubious partners and the debate around gambling advertising is not exclusive to the UK. Many European countries and leagues face pressure to ban or restrict gambling advertising in sports. Some have already implemented such legislation, while other are planning to in the coming years.

From Europe’s major competitions, Serie A teams were the first to face a government-imposed ban on gambling advertising in 2019. Clubs were allowed to continue their partnerships until the end of the 2018/19 season. The main concerns at the time were a loss of revenue and the possibility of it creating a competitive disadvantage compared to other European clubs.

Spain followed suit in 2021, when the government prohibited all gambling advertising in sports. Spanish football clubs had to end all gambling sponsorship deals by the end of the 2020/21 season. La Liga teams foresaw an estimated €90 million loss.

Germany, like France, has currently no complete ban on gambling sponsorships nor advertising. Bundesliga clubs have few gambling shirt sponsors though. They do, just as the league does, have betting partners receiving exposure through in-stadium advertising.

The Netherlands and Belgium are set to prohibit all gambling advertising from 2025 and 2028 onwards respectively. The Eredivisie, currently the sixth biggest league according to UEFA, believes it will result in a loss of €40 to 70 million. The Belgian Pro League laments the financial implications of a complete ban as well, although like most leagues they are in favour of stricter regulations.

Gambling Advertising in other European Leagues

| Country – league | Situation |

|---|---|

| UK – Premier League | Front-of-shirt sponsorship prohibited from 2026/27 onwards |

| Italy – Serie A | Prohibited since 2019/20 |

| Spain – La Liga | Prohibited since 2021/22 |

| Germany – Bundesliga | No front-of-shirt sponsorship ban |

| France – Ligue 1 | No front-of-shirt sponsorship ban |

| The Netherlands – Eredivisie | Prohibited from 2025 onwards |

| Portugal – Primeira Liga | No front-of-shirt sponsorship ban |

| Belgium – Pro League | Prohibited from 2028 onwards |

Other Brands, Same Risks?

When the Serie A and La Liga were hit by government-imposed bans on gambling advertising, there were concerns about the financial impact and about the kind of companies replacing them. Especially in the beginning, companies offering financial services, like online trading platforms and cryptocurrencies, and gaming brands took over. However, some of these companies and the services they offer bring their owns risks. The YouGov study found that 60 percent of fans see cryptocurrency companies as inappropriate marketing partners. 19 percent deemed them appropriate, the same percentage that deemed gambling companies, appropriate partners.

When the Serie A and La Liga were hit by government-imposed bans on gambling advertising, there were concerns about the financial impact and about the kind of companies replacing them. Especially in the beginning, companies offering financial services, like online trading platforms and cryptocurrencies, and gaming brands took over. However, some of these companies and the services they offer bring their owns risks. The YouGov study found that 60 percent of fans see cryptocurrency companies as inappropriate marketing partners. 19 percent deemed them appropriate, the same percentage that deemed gambling companies, appropriate partners.

When these companies take over as front-of-shirt sponsors from betting firms, new concerns will arise. In addition, although the Premier League may be the first UK sports league to voluntarily ban front-of-shirt gambling advertising, the proposed changes have limitations. It is limited to the Premier League, does not cover all advertising, and comes only into effect in three years. Gambling companies will shift their advertising focus to sleeves and general (in-stadium) advertising, especially since they are also not allowed to partner with sports stars and celebrities since 2022.

The voluntary ban on front-of-shirt gambling advertising will change the Premier League’s sponsorship market. New companies will become visible on matchday shirts. However, it remains to be seen whether the partial ban will indeed reduce the amount of gambling advertising.